Navigating tax deadlines can be tricky, but understanding key dates and extensions is crucial for staying compliant with the IRS. This guide simplifies the federal filing deadlines for 2023, including extensions for disaster-affected areas, IRA contributions, and health savings account contributions. Whether you’re filing for yourself or advising clients, this article provides a clear roadmap for meeting tax obligations in 2024.

Federal Tax Filing Deadlines for 2023 Returns:

- General Deadline: Monday, April 15, 2024

- Applies to individual returns (Form 1040), C Corporations (Form 1120), and Estate/Trust returns (Form 1041)

- Maine and Massachusetts Residents: Wednesday, April 17, 2024, due to Patriot’s Day and Emancipation Day holidays

Deadline Extensions for Disaster-Affected Areas:

- June 17, 2024:

- California (San Diego area)

- Michigan (Eaton, Ingham, Ionia, Kent, Livingston, Macomb, Monroe, Oakland, and Wayne counties)

- Washington (Spokane County)

- West Virginia (Boone, Calhoun, Clay, Harrison, and Kanawha counties)

- Maine (Androscoggin, Franklin, Hancock, Kennebec, Oxford, Penobscot, Piscataquis, Somerset, Waldo, and Washington Counties affected by severe storms and flooding on December 17, 2023)

- Rhode Island (Providence County affected by severe storms, flooding and tornadoes)

- Connecticut (New London County, including the Mohegan Tribal Nation and Mashantucket Pequot Tribal Nation)

- July 15, 2024:

- Alaska (Wrangell Cooperative Association of Alaska Tribal Nation)

- Maine (Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington and York counties affected by severe storms and flooding on January 9, 2024)

- Rhode Island (Kent, Providence and Washington counties affected by severe storms and flooding on December 17, 2023 and January 9, 2024)

- August 7, 2024: Hawaii (Individuals and households affected by wildfires in Maui and Hawaii counties)

Other Important Deadlines:

- IRA Contributions: April 15, 2024, for Tax Year 2023

- Health Savings Account (HSA), Archer Medical Savings Account, or Coverdell ESA Contributions: April 15, 2024, for Tax Year 2023

- 1st 2024 Estimated Tax Payment (1040-ES): April 15, 2024

- Extension Request Deadline (Form 4868) for Individuals: April 15, 2024 (extends filing to October 15, 2024)

- Extension Request Deadline (Form 7004) for Calendar Year Corporations and Estates/Trusts: April 15, 2024 (extends filing to October 15, 2024)

Extension Reminder: Extensions grant more time to file, not to pay any tax due. If tax is owed, it must be paid by April 15, 2024, to avoid penalties and interest.

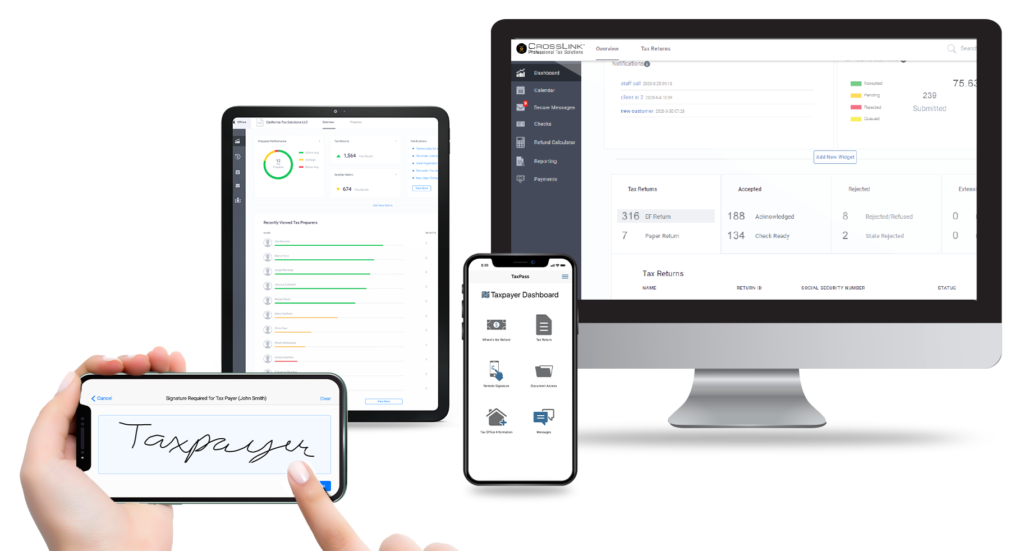

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.