Tax season can be a stressful time for many individuals and businesses alike. As tax preparers, one of the most valuable services we can provide to our clients is helping them maximize their tax deductions. By identifying and leveraging lesser-known deductions and techniques, we can potentially save our clients hundreds or even thousands of dollars on their tax bills.

In this guide, we will explore the importance of maximizing tax deductions for clients and introduce the concept of lesser-known deductions and techniques. Understanding these strategies can not only benefit our clients financially but also strengthen our expertise as tax professionals.

Understanding Tax Deductions

A tax deduction is an expense that an individual taxpayer can use to reduce their taxable income, thereby lowering their tax liability. There are two types of deductions on a federal income tax return:

Itemized deductions: These are expenses that can be claimed on Schedule A of the tax return. To claim itemized deductions, the total of these expenses must exceed the standard deduction for the individual’s filing status. Some examples of itemized deductions include:

- Medical insurance and other medical and dental expenses: These expenses must exceed 7.5% of the individual’s adjusted gross income to be included as an itemized deduction.

- Real estate, sales, and state income taxes.

- Home mortgage interest.

- Charitable contributions, including both cash and non-cash donations.

- Casualty losses related to a federally declared disaster.

Other deductions: These deductions can be claimed on an individual’s federal return even if they claim the standard deduction. Some examples include:

- Alimony payments for divorces finalized before 2019.

- Business use of a taxpayer’s car or home if they are self-employed.

- Contributions to an IRA or Health Savings Account.

- Student loan interest.

- Educator expenses for teachers.

- Moving expenses for members of the military.

- Expenses related to a business reported on Schedule C.

- Expenses related to a rental reported on Schedule E.

Importance of Keeping Accurate Records and Documentation for Deductions

It is crucial for individuals to keep complete and accurate records, along with receipts, for any deductions they claim. Without proper documentation, the IRS may disallow a deduction if they inquire about it or audit the taxpayer’s return in the future. Keeping organized records can help individuals substantiate their deductions and avoid potential issues with the IRS.

Commonly Overlooked Deductions

Clients often overlook certain deductions that can significantly reduce their tax liability. Here are some lesser-known deductions that clients should be aware of:

Home Office Deduction:

- Self-employed individuals who use part of their home as an office may claim an expense for that use.

- When claiming the Home Office Deduction, self-employed individuals can either take their actual expenses for this use or use the simplified method as explained in the Schedule C instructions.

Educator Expenses Deduction:

- Teachers and other qualified educators may deduct up to $300 for classroom expenses they pay for themselves.

- This deduction is reported on Form 1040, Schedule 1, line 11.

Health Savings Account (HSA) Contributions:

- Individuals who have set up an eligible HSA can make deductible contributions to pay for qualified medical expenses.

- The allowable deduction is calculated on Form 8889 and appears on Form 1040, Schedule 1, line 13.

Moving Expenses Deduction for Members of the Military:

- Members of the Armed Forces on active duty may deduct unreimbursed moving expenses due to a military order or permanent change of station.

- This deduction is calculated on Form 3903and appears on Form 1040, Schedule 1, line 13.

Student Loan Interest Deduction:

- Individuals who paid interest on their student loan during the year may deduct the amount of interest paid as an adjustment to their income on Form 1040, Schedule 1, line 21.

- The deduction is limited to the lesser of $2,500 or the amount of interest paid during the year, subject to income limits.

Techniques to Optimize Tax Deductions

To maximize tax deductions, taxpayers can employ strategies that focus on timing deductions to maximize their impact. Here are some techniques to consider:

Timing Deductions:

- Towards the end of each year, taxpayers should evaluate whether to spend money on an expense item that will result in a tax deduction for the current year or defer it to the next year.

- Consideration should be given to the taxpayer’s current year income, eligibility to itemize deductions, and whether an additional tax deduction for the current year will reduce their taxable income more for the current year or for the projected income for the next year.

Maximizing Deductions:

- If the total of an individual’s itemized deductions is close to being greater than their standard deduction for their filing status, they should consider donating or making additional contributions to a charitable organization.

- If out-of-pocket medical expenses are close to being above 7.5% of their adjusted gross income, consider spending more on any out-of-pocket prescriptions or other needed medical expenses before the end of the current year instead of waiting for the next year.

These techniques can help taxpayers optimize their tax deductions and potentially reduce their tax liability. It’s important to consult with a tax professional to determine the best strategy based on individual circumstances.

Working with Clients to Maximize Deductions

Tax preparers play a crucial role in helping clients understand and maximize their tax deductions. Here’s why ongoing communication and education are essential:

Education on Available Deductions:

- Tax preparers should educate their clients about the tax deductions available to them.

- By explaining the deductions that may be applicable to their clients’ tax situations, preparers can help clients reduce their taxable income, potentially increasing their refund or lowering the amount of tax due.

Tax Planning Throughout the Year:

- Tax preparers can provide tax planning services to clients throughout the year.

- By discussing tax planning strategies with clients, preparers can help them make informed decisions that may result in tax savings.

Expanding Services:

- Offering tax planning services can help tax preparers expand their services and strengthen their client relationships.

- By providing ongoing communication and education, preparers can demonstrate their expertise and value to clients.

By communicating regularly with clients and providing them with the information they need to maximize their deductions, tax preparers can help clients achieve their financial goals and improve their overall tax situation.

Maximizing tax deductions is crucial for reducing tax liability and saving money. By understanding the various deductions available, including lesser-known ones, and employing strategies to optimize deductions, tax professionals can greatly benefit their clients. Proactive tax planning and ongoing communication are key in this process. Tax preparers are encouraged to explore these deductions and techniques to benefit their clients’ financial well-being.

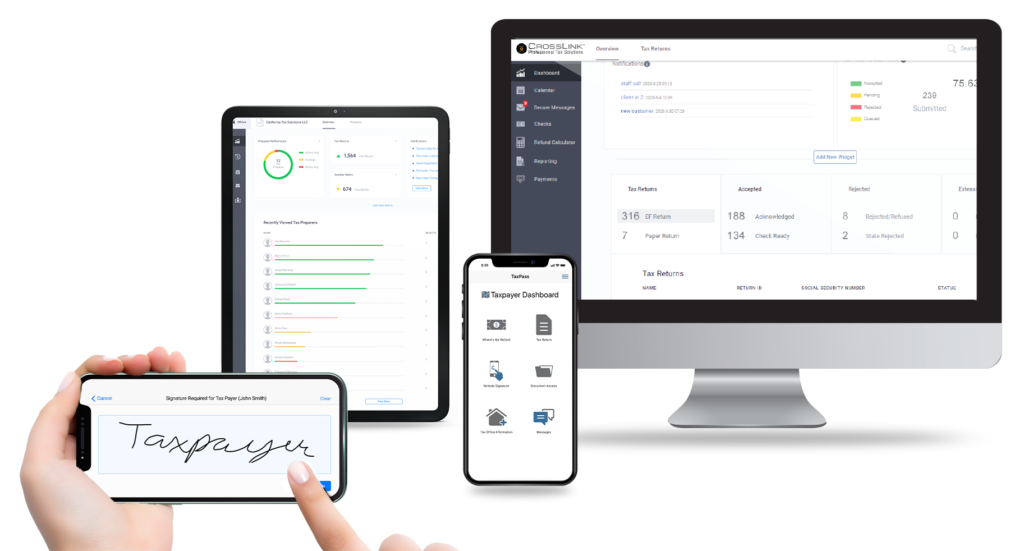

For tax preparers looking to streamline their tax preparation process and offer comprehensive tax planning services to their clients, consider CrossLink Tax Software. Our software is designed to simplify tax preparation, maximize deductions, and improve overall efficiency. Upgrade your tax preparation process today and provide your clients with the best possible service.

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.