Accurate tax filing is crucial for individuals and businesses alike, as it ensures compliance with tax laws and regulations. Failing to file accurately can result in penalties, audits, and delays in refunds, which can be both costly and time-consuming. In this guide, we will discuss some common tax errors and provide tips on how to avoid them, helping you navigate the tax filing process with confidence and accuracy.

Filing Status Errors: Understanding Your Options When Filing Federal Income Tax Returns

One of the fundamental aspects of filing a federal income tax return is determining the appropriate filing status. This status is generally based on whether an individual was single or married as of the last day of the tax year. The available filing statuses for federal returns are as follows:

- Single: This status is for individuals who are unmarried, divorced, or legally separated as of the last day of the year, or who do not qualify for any other filing status.

- Married Filing Jointly: This status is available to married individuals if they were married at the end of the year or if their spouse died during the year.

- Married Filing Separately: Married individuals can choose this status if they are married but do not wish to file a joint return.

- Head of Household: This status applies to unmarried individuals or those considered unmarried at the end of the year who paid more than half the cost of maintaining a home for the year and had a qualifying person living with them for more than half the year.

- Qualifying Surviving Spouse: This status can be chosen for the two years following the year in which a spouse died, provided the individual meets specific criteria, including having a dependent child or stepchild who lived with them all year and for whom they provided more than half the cost of maintaining a home.

Understanding these filing statuses is essential for accurate tax filing, as choosing the wrong status can lead to errors, penalties, and delays in processing refunds.

Consequences of Choosing the Wrong Filing Status

The filing status selected on a federal tax return impacts several key aspects of the tax filing process. It determines the amount of the standard deduction, eligibility for certain tax credits, and the calculation of the tax owed. Selecting the wrong filing status can have significant implications, including:

- Ineligibility for certain tax credits and deductions

- Qualification for a lower standard deduction

- A potentially higher tax liability

It is crucial to carefully consider and accurately select the appropriate filing status to avoid these consequences and ensure compliance with tax laws.

Tips for Determining the Correct Filing Status

Selecting the right filing status is crucial for accurate tax filing. Here are some resources that individuals can use to help determine which filing status to choose when preparing a federal income tax return:

- IRS Interactive Tax Assistant – What is My Filing Status?: This online tool on the IRS website provides guidance on determining the appropriate filing status based on an individual’s marital status and other relevant factors.

- IRS Publication 501 (Dependents, Standard Deduction, and Filing Information): This publication provides detailed information on filing statuses, including the criteria for each status and examples to help individuals determine their correct status.

- Form 1040 Instructions: The instructions for Form 1040 also provide guidance on determining filing status, including information on who qualifies for each status and how to choose the correct one.

- IRS Publication 17 (Your Federal Income Tax for Individuals): This publication, starting on page 22, provides comprehensive information on federal income tax filing for individuals, including guidance on determining filing status.

Additionally, individuals can use tax software or consult a reputable tax preparer to ensure they have selected the correct filing status based on their marital status and other relevant circumstances. These tools and resources can help individuals avoid errors and ensure compliance with tax laws.

Mathematical Errors: Avoiding Common Mistakes in Tax Calculation

One of the most frequent errors individuals make when preparing their federal income tax return is in the realm of math. These errors can lead to significant delays in processing and impact the accuracy of refunds. Here are some common mathematical mistakes seen on federal income tax returns:

- Incorrect Tax Calculation: Errors in calculating the total tax amount.

- Incorrect Addition or Subtraction: Mistakes in adding or subtracting numbers on the return itself.

- Incorrect Calculation of Income and Deductions: Failing to accurately calculate income and deduction amounts entered on the return.

- Incorrect Standard Deduction Amount: Not entering the correct standard deduction amount based on the individual’s filing status.

- Errors in Tax Credits: Calculating the wrong amount for credits such as the child tax credit, earned income tax credit, or education credits on Form 8863.

The Impact of Mathematical Errors on Tax Returns

Math errors can lead to delays in processing tax returns and refunds. When the IRS identifies a mathematical error, they will send the return to their Error Resolution System for review. The IRS will then correct the error using their math error authority and send the taxpayer a notice detailing the adjustment, correction, and any resulting balance due or corrected refund amount.

To avoid these issues, it is crucial to double-check all calculations and consider using tax preparation software or consulting with a tax professional. By taking these precautions, individuals can minimize the risk of mathematical errors and ensure a smoother tax filing process.

Tips to Avoid Mathematical Errors in Tax Returns

To minimize the risk of mathematical errors when preparing a federal income tax return, individuals can follow these tips:

- Use a Calculator: Use a calculator when totaling the lines on the return itself and on worksheets used to calculate credits and deductions.

- Double-Check Amounts: Double-check the amounts entered on the return against the source documents, such as W-2s, to ensure accuracy.

- Verify Using Tables: Double-check the amounts entered for the standard deduction, tax due, and any credits that use a table in the federal instructions.

- Consider Professional Help: Obtain the services of a reputable tax preparer to prepare the return.

- Use Tax Software: Use income tax software, which can help reduce mathematical errors and ensure accurate calculations.

By following these tips, individuals can minimize the risk of mathematical errors and help ensure a smoother tax filing process.

Missing or Incorrect Information: Ensuring Accuracy in Tax Returns

Providing accurate and complete information on a tax return is crucial. Individuals should gather all necessary documents before preparing their return and ensure that the information entered is accurate. This includes:

- Social Security Numbers: Ensure accurate entry of your own, your spouse’s, and any dependent’s Social Security numbers.

- Names: Enter your full name, your spouse’s name, and any dependent’s name accurately.

- Address: Provide your current address.

- Income: Report all income from W-2s, 1099s, and other documents accurately.

- Health Insurance Information: Include information from Form 1095-A if you obtained health insurance from the marketplace or exchange.

Failure to report this information accurately or omitting necessary information can result in:

- Missing out on credits or deductions.

- Delay in processing your tax return and receiving your refund.

- Receiving an IRS notice adjusting the tax due, potentially resulting in a smaller refund or owing additional tax and penalties.

Common mistakes related to missing or incorrect information include:

- Inaccurate Social Security Numbers

- Misspelled names

- Inaccurate entry of information from W-2s, 1099s, and other information returns

- Failure to sign the return

- Incorrect routing number and/or bank account number for direct deposit

To ensure all necessary information is included and accurate, follow these tips:

- Gather all W-2s, 1099s, and other income documents.

- Double-check Social Security numbers, names, and addresses.

- Review your prior year’s tax return to ensure you’re not missing any income items for the current year.

Taking these steps will help ensure your tax return is accurate and complete, minimizing the risk of errors and potential delays or penalties.

Deduction and Credit Errors: Avoiding Common Pitfalls

Errors related to deductions and credits can lead to unnecessary penalties and delays in processing tax returns. It’s important to understand and avoid these common mistakes.

- Calculation Errors: Incorrectly calculating credits or deductions using the worksheet provided in the federal form instructions.

- Eligibility Misunderstanding: Not understanding the eligibility requirements for a credit or deduction.

- Income Limit Exceeded: Exceeding the income limit for claiming a particular credit or deduction.

These are specific errors related to federal tax credits:

Earned Income Tax Credit (EITC)

- Child does not meet qualification rules

- More than one person claims the same child

- Social Security Number or Last Name does not match the Social Security Administration’s records

- Incorrect filing status claimed (e.g., Single or Head of Household instead of Married)

Child Tax Credit

- Child is over the age of 16

- Child does not have the required SSN (Individual Taxpayer Identification Number (ITIN) not eligible)

American Opportunity Education Credit

- Claiming the credit for a student who did not attend an eligible educational institution

- Claiming the credit for a student who had already completed the first four years of post-secondary education

To avoid these errors, consider the following tips:

- Maintain Thorough Records: Keep records to prove eligibility for credits or deductions.

- Understand Requirements: Read federal form instructions and related publications to understand the requirements.

- Double-Check Calculations: Double-check calculations on applicable worksheets for accuracy.

- Ensure Correct Information: For credits, verify that names and Social Security Numbers are entered correctly.

By following these tips, taxpayers can reduce the risk of errors and ensure a smoother tax filing process.

Consequences of Filing Late or Not Filing at All

Filing late or not filing at all can have serious consequences, depending on whether the individual is due a refund or owes taxes.

For Returns with Expected Refunds:

- Filing late delays the receipt of any refund owed.

- If a return is not filed within three years of the due date for the tax year in question, the individual will lose their refund.

For Returns with Taxes Owed:

- Late or non-filing results in owing any taxes due, along with penalties:

- Failure to File Penalty: 5% of the unpaid taxes for each month or part of a month the return is late, up to a maximum of 25% of the unpaid taxes.

- If the return is more than 60 days late, the minimum penalty is $485 or 100% of the unpaid tax, whichever is less.

- Failure to Pay Penalty: 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid, up to a maximum of 25%.

- If the IRS sends an intent to levy notice, the penalty increases to 1% per month.

- If an approved payment plan is in place, the penalty is reduced to 0.25% per month.

- Failure to File Penalty: 5% of the unpaid taxes for each month or part of a month the return is late, up to a maximum of 25% of the unpaid taxes.

It is important to file tax returns on time, even if full payment cannot be made, as this can reduce the penalties associated with late payment.

Common Reasons for Late or Non-Filing of Tax Returns

There are several common reasons why individuals may file their federal income tax returns late or not at all:

- Lack of Awareness of the Filing Deadline: Some individuals may not be aware of the tax filing deadline.

- Procrastination: Some individuals may postpone filing due to other responsibilities or a perception that there are no immediate consequences for filing late or not at all.

- Complexity of the Tax Return: The complexity of tax returns can be overwhelming for some individuals, leading to delays or avoidance of filing.

- Inability to Pay Taxes Due: Some taxpayers may avoid filing because they are unable to pay or fully pay the balance due on their return.

Tips to Ensure Timely Filing

To ensure timely filing of federal income tax returns, individuals can take the following steps:

- Familiarize Themselves with Due Dates: Be aware that the individual tax return deadline is April 15 each year, with an automatic extension available until October 15 if needed.

- Seek Professional Help: Consider obtaining the services of a tax professional to assist with tax preparation.

- Use Tax Software: Utilize income tax software, which can help simplify the tax preparation process and reduce the likelihood of errors.

Avoiding common tax errors is crucial to ensure a smooth and accurate tax filing process. Mistakes can lead to penalties, delays in refunds, and unnecessary stress. It is essential for taxpayers to double-check their tax returns for accuracy before submitting them to the IRS.

For further assistance and resources, individuals can visit the IRS website, which offers a wealth of information and tools to help with tax preparation. Additionally, seeking the guidance of tax professionals can provide personalized advice and ensure compliance with tax laws. Taking these steps can help taxpayers navigate the tax filing process with confidence and peace of mind.

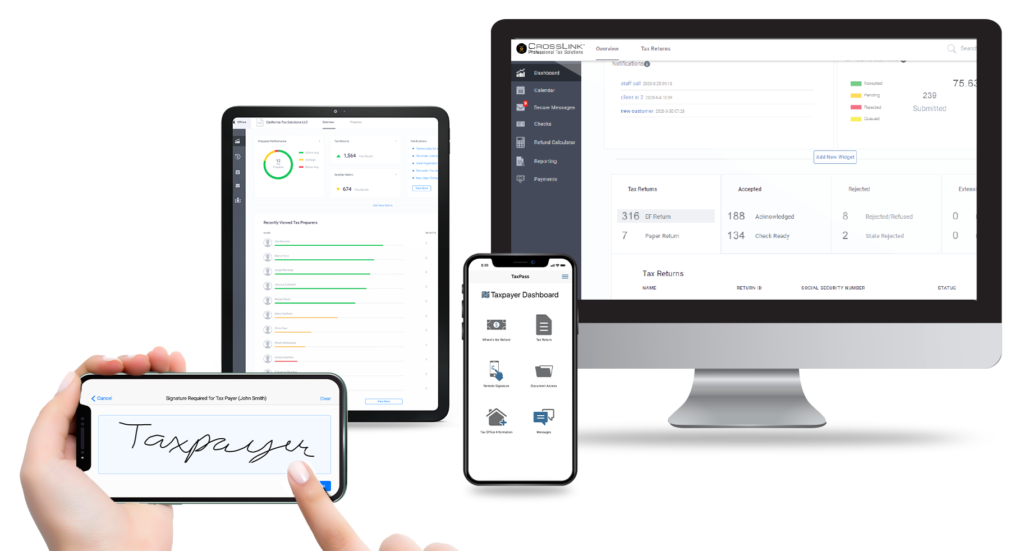

If you’re a tax professional seeking a software solution for a streamlined, accurate, and efficient tax preparation process, explore our products and pricing today.

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.