2023 IRS Security Summit Awareness Campaign

This year’s Security Summit tax professional summer campaign is emphasizing the following series of simple actions that they can take to better protect their clients and themselves from sensitive data theft.

Protect Your Clients; Protect Yourself from Identity Theft

For the eighth year the Internal Revenue Service and its Security Summit partner are working to ensure that tax professionals remain alert against new and ongoing threats of tax-related identity theft.

Create a Security Plan

The Security Summit partners are encouraging tax preparers, especially those with smaller practices, to take advantage of the Written Information Security Plan template which is designed to help make creating a data security plan easier for tax preparers.

As a reminder federal law requires all tax preparers to create and implement a data security plan. The Security Summit (a private public partnership between the IRS, states and tax industry) has noticed that a number of tax professionals are struggling to develop a written security plan.

The template is contained in IRS Publication 5708 (Creating a Written Information Security Plan for your Tax & Accounting Practice). This 28-page, easy to understand document was developed by the Security Summit partners, begins with the basics and walks a tax preparer through getting started on a plan, including understanding their security compliance requirements and professional responsibilities to protect their clients sensitive tax return information.

See IRS News Release IR-2023-129 (Specially designed Security Summit plan helps tax pros protect data) for more information on creating a written security plan for your tax practice and for additional resources that are available to help tax preparers secure their computer systems.

Sign Up Clients for Identity Protection PINs (IP PIN)

Identity Protection PINs, also referred to as IP PINs, serve as a critical defense against identity thieves. The IRS, state tax agencies and the nation’s tax industry (working together as the Security Summit) need assistance from tax preparers to let their clients know that IP PINs are available to all individuals and that they help to verify that the return they are filing with the IRS is truly their return.

See IRS News Release IR-2023-134 (Identity Protection PINs are an important tool against tax-related identity theft) for how individuals can sign up and the benefits of having an IP PIN.

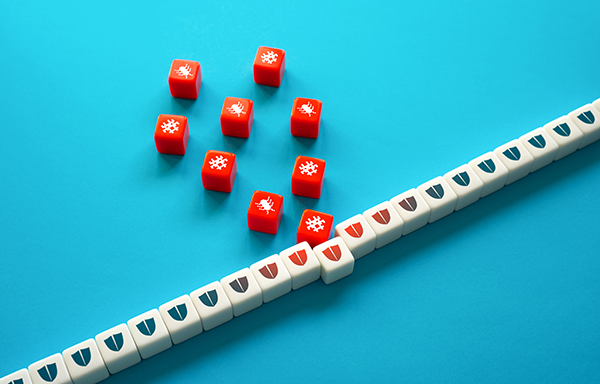

Avoid Email Phishing, Spear Phishing and Whaling Scams

The IRS and its Security Partners continue to see a steady stream of email related attacks that are aimed at tax preparers with a goal of stealing sensitive tax and financial information from their tax clients.

Tax preparers need to be aware of the different type of email related phishing schemes that are aimed at tricking tax preparers or individuals into disclosing information such as passwords, bank account numbers, credit card numbers, Social Security numbers and other personal information.

Here are terms that tax preparers should be aware of:

- Phishing/Smishing – Phishing emails and smishing SMS/texts attempt to trick the recipient into clicking on a suspicious link, filling out information, or downloading a malware file.

- Spear Phishing – A type of phishing scam that bypasses emailing to large groups at an organization, but instead identifies potential victims and delivers a more realistic email known as a “lure. These can pose as a potential client for a tax preparer, luring the practitioner into sharing sensitive information.

- Whaling – Whaling attacks are similar to spear phishing; except they are generally aimed at leaders or other executives with access to secure large amounts of information at an organization or business.

See IRS News Release IR-2023-138 (Tax pros should remain vigilant against phishing emails and cloud-based attacks) for more information on the warning signs of scams and the risks of cloud-based schemes and the importance of using multi-factor authentication when accessing their cloud-based information system.

Also, see IRS News Release IR-2023-131 for a list and description of the most recent wave of activity involving tax scammers.

Know the Tell-tale Signs of Identity Theft

Tax professionals who are victims of fraudsters have frequently stated that they did not immediately recognize the signs of data theft.

Tax preparers should be on the lookout for the following critical warning signs that their system may have been breached and that data theft may have occurred:

- Their clients receive notice that an online account was created without their consent or that:

- Someone accessed their IRS online account without their knowledge

- The IRS disabled their online account

- A client’s tax return is rejected because their SSN was already used on another return.

- Clients receive a tax transcript that they did not request.

- Balance due or other notices from the IRS are received that are not correct based on the tax return that was filed.

- IRS records show more e-file acknowledgements received than the tax preparer has filed.

- A client has responded to an email from the tax preparer that the tax preparer did not send.

- Slow or unexpected computer and/or network issues

See IRS News Release I.R. 2023-143 (Identity theft red flags tax pros should know) on the IRS website for more information on additional warning signs that data theft might have occurred and what tax preparers should do if they become a victim of data theft.

Tax Preparers Need to Plan, Protect, and Defend Against Identity Theft

IRS and Security Summit partners continue to urge tax preparers to take critical steps to protect their information. This includes taking extra care with how they handle data and security at their business and at home.

See IRS News Release IR-2023-147 (IRS reminds tax pros to plan, protect, defend against identity theft) for important reminders on how tax preparers can reduce identity theft risk.

See the following on the IRS website for more information on the IRS Security Summit and this summer’s Protect Your Clients; Protect Yourself – Summer 2023 awareness campaign:

- Security Summit page

- Protect Your Clients; Protect Yourself – Summer 2023 page

- IRS Publication 4557 – Safeguarding Taxpayer Data

- Data Theft Information for Tax Professionals

- IRS Publication 5461-D – Tax professionals should review their security protocols

CrossLink Professional Tax Software

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers an unparalleled experience.