Event Giveaway: Win a Meta Quest 3S!

How to Enter:

Sign up with CrossLink by purchasing CrossLink Desktop or CrossLink Online software for the 2026 tax season by May 22, 2025 and you’ll automatically earn an entry into the giveaway.*

*No purchase necessary. See official rules.

Win a Meta Quest 3S!

Ready to experience the future?

Win a Meta Quest 3S!

Ready to experience the future?

CrossLink is giving away two Meta Quest 3S headsets to celebrate tax professionals who are ready to level up their business — and their downtime.

Entering is simple: purchase CrossLink Desktop or CrossLink Online software for the 2026 tax season by May 22, 2025, and you’ll be entered for a chance to win.* Two winners will be randomly selected to take home one of the most exciting pieces of technology of the year!

CrossLink is giving away two Meta Quest 3S headsets to celebrate tax professionals who are ready to level up their business — and their downtime.

Entering is simple: purchase CrossLink Desktop or CrossLink Online software for the 2026 tax season by May 22, 2025, and you’ll be entered for a chance to win.* Two winners will be randomly selected to take home one of the most exciting pieces of technology of the year!

What You Get with a Meta Quest 3S

Immersive VR Experiences: Dive into games, entertainment, and learning like never before with powerful graphics and real-world movement tracking.

Wireless Freedom: No cables, no limits — enjoy total freedom of movement with wireless VR.

Built for Work and Play: From fitness and fun to productivity tools, the Meta Quest 3S adapts to your lifestyle.

*No purchase necessary. See official rules.

Why Choose CrossLink?

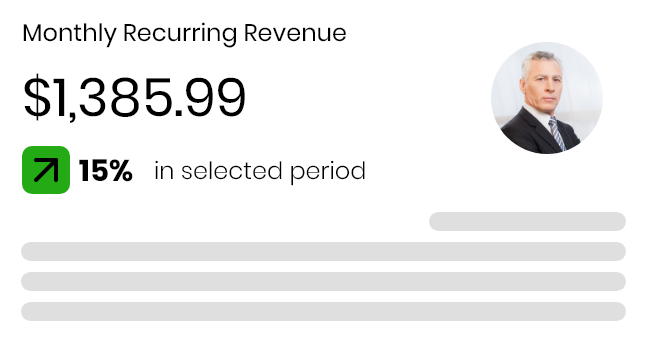

Capitalize this tax season by increasing your revenue through new opportunities and offering clients added ancillary services.

Members who enroll in Audit Allies receive the coveted Certified Audit Ally Badge, symbolizing your expertise, reliability, and dedication to your clients.

By enrolling in iPROTECT, you’ll earn the Certified Identity Pro Badge, showcasing your expertise, trustworthiness, and commitment to serving your clients.

1Provided through our affiliated company Audit Allies, LLC.

Integrate your business

Connect your CRM, send emails automatically to clients, and send Slack messages to your staff with our Zapier integration.

Connect to thousands of apps to automate your workflows and make your daily operations smoother than ever.

Trusted by thousands of professionals since 1989.

Integrated Bank Products

Empower your tax business with our seamless integrations with our banking partners designed to enhance the experience for both you and your clients. Our integrations with industry-leading banking partners make tax preparation more accessible by streamlining payment and refund processes.

How Long do Refunds Typically Take to Fund?

Refunds typically fund within 21 days after the IRS accepts the return.

Timing may vary depending on IRS processing times and the selected disbursement method.

A Refund Advance is a game-changer for your clients! It gives them early access to a portion of their expected refund, making it easier to cover immediate expenses.

The best part? Repayment happens automatically when the IRS processes their refund—no extra hassle for you or your client.

Increase Revenue. Elevate Your Business with CrossLink.

Our game-changing programs turn everyday tax preparation into a profit powerhouse.

Take your tax office to the next level with innovative tools that grow your income and strengthen client trust.

No purchase necessary. See official rules.

Request a demo or give CrossLink a try!