IRS Announces Delay in Form 1099-K Reporting Threshold for 2023

Following feedback from taxpayers, tax professionals and payment processors, the IRS announced on November 23 that the requirement that was enacted in the American Rescue Plan Act of 2021 that lowered the reporting threshold from $20,000 to $600 for third-party networks that process payments for transactions that involve the selling of goods or services will be delayed until 2024.

The IRS also announced that the $600 threshold will also be phased-in. For 2024, the IRS is planning for the reporting threshold to be $5,000.

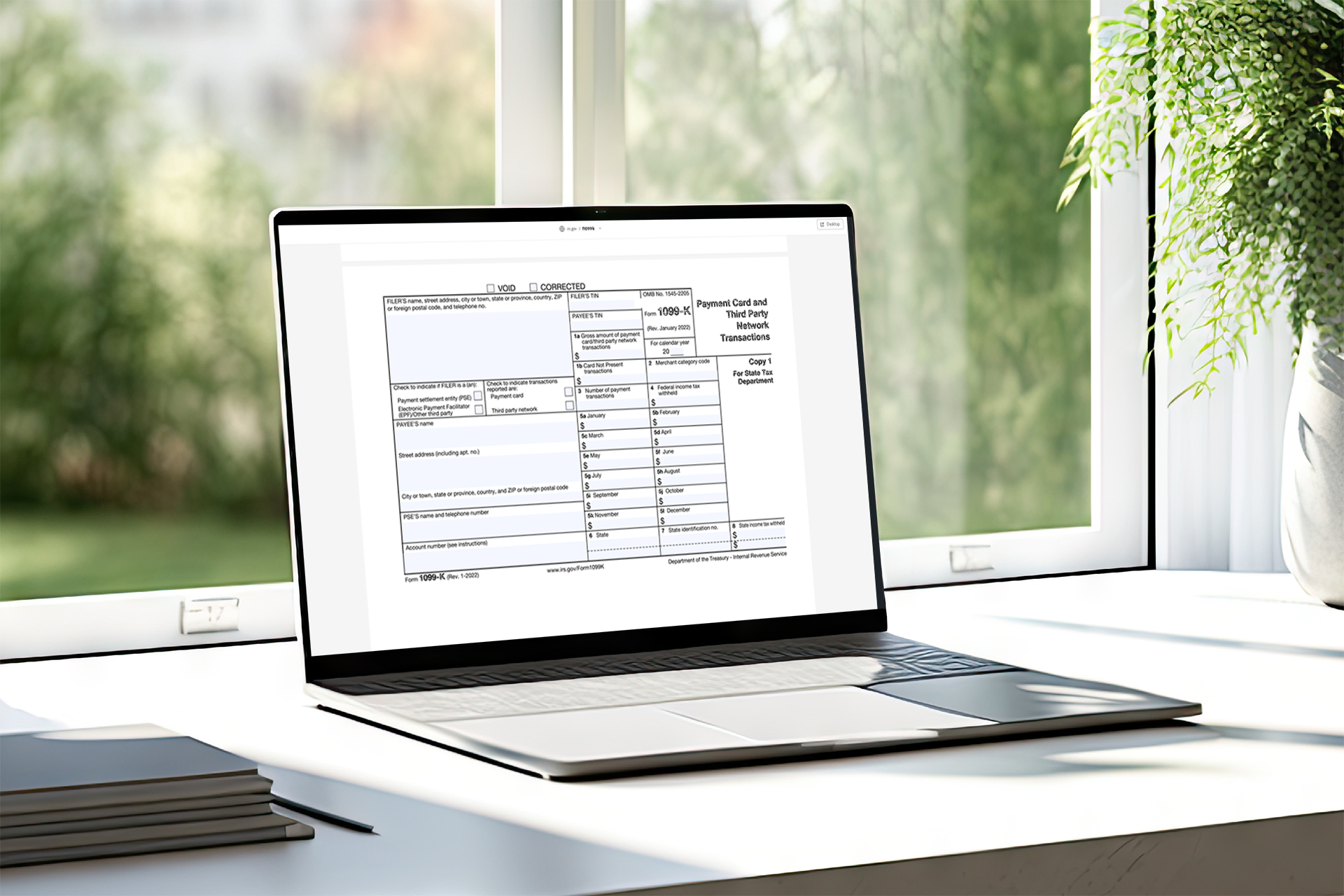

As with last year, this means that individuals who used a third-party payment network (such as Venmo, Cash App, Zelle, PayPal, or Apple Pay) to sell goods or to receive income for providing services under $20,000 and had less than 200 transactions during 2023 should not receive a Form 1099-K (Payment Card and Third-Party Transactions) in early 2024.

What if you receive Form 1099-K in 2024?

Since 2023 is again considered a transition year and the delay of the lower reporting threshold was not announced until late in 2023, some individuals may receive a Form 1099-K in early 2024 if the total transactions of their third-party transactions were between $600 and $20,000.

The following individuals who receive a Form 1099-K from a third-party network in early 2024 that was for the sale of goods in the individual’s business, for services provided or certain sales of personal items must report this income on their federal return as follows:

- Sole proprietors or farmers that receive income for goods and/ or services related to their business or farm. The income must include the amounts from their 1099-K with other amounts of income they received and report the total on Schedule C (Profit or Loss from Business) for sole proprietors or Schedule F (Profit or Loss from Farming) for farmers.

- Individuals who receive rental income either for long-term or short-term rentals must report this income on Part I of Schedule E (Supplemental Income and Loss).

- Individuals who sell personal items, such as gold, silver bullion, coin or gems, that they are holding as an investment must report the sale on Form 8949 (Sales and Other Dispositions of Capital Assets) and recognize either a long-term or short-term capital gain or loss.

- Individuals who sell a personal item that resulted in a gain must report the gain as a short-term capital gain on Form 8949.

- Individuals who do Gig work such as for Uber or Lyft must report this income on Schedule C.

For those individuals who receive a 1099-K for amounts over $600 for the following scenarios the IRS has stated in the Form 1040 instructions for Schedule 1, line 8z and 24z how to report the following on their federal return:

- Sale of personal items such as a car, appliances, furniture, household items, etc. at a loss. The amount from the Form 1099-K should be entered as follows on Form 1040, Schedule 1:

- Enter the amount from line 1a from the Form 1099-K on Schedule 1, line 8z and in the entry line next to line 8z enter “Form 1099-K Personal Item Sold at a Loss – $XXXX (Amount from the Form 1099-K)”.

- Enter the amount from line 1a from the Form 1099-K on Schedule 1, line 24z and in the entry line next to line 24z enter “Form 1099-K Personal Item Sold at a Loss – $XXXX (Amount from the Form 1099-K)”.

- Received a 1099-K in error and are unable to have it corrected by the payer. The amount from the Form 1099-K should be entered on Form 1040, Schedule 1 as follows:

- Enter the amount from line 1a from the Form 1099-K on Schedule 1, line 8z and in the entry line next to line 8z enter “Incorrect Form 1099-K – $XXXX (Amount from the Form 1099-K)”.

- Enter the amount from line 1a from the Form 1099-K on Schedule 1, line 24z and in the entry line next to line 24z enter “Incorrect Form 1099-K – $XXXX (Amount from the Form 1099-K)”.

For more information see the following on the IRS website:

- IRS News Release IR 2023-221 – IRS announces delay in Form 1099-K reporting threshold for third party payment platform payments in 2023; plans for a threshold of $5,000 for 2024 to phase in implementation

- IRS Notice 2023-74 – Revised Timeline Regarding Implementation of Amended Section 6060W(e)

- IRS Fact Sheet 2023-27 (IRS announces 2023 Form 1099-K reporting threshold delay for third party payment platform payments)

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.