On January 19, 2024 the IRS officially ended the moratorium on the Certified Acceptance Agent (CAA) program, signaling the reopening of applications for both new participants and renewals. This program authorizes individuals or entities (including businesses or organizations) to assist those who require a Taxpayer Identification Number (TIN) but do not qualify for a Social Security Number, specifically for processing Form 1040 and other tax schedules.

Under the CAA program, acceptance agents streamline the application process for an Individual Taxpayer Identification Number (ITIN) by reviewing essential documents and submitting completed Forms W-7 to the IRS. The recent update brings a more streamlined and modernized application process, transitioning all submissions to an online format through the applicants’ IRS E-Services accounts. This shift is expected to significantly reduce processing time, from the previous 120 days to a more efficient 60 days.

Individuals Who Need to Renew Their Application

For individuals needing to renew their application, especially those whose acceptance agent agreement lapsed on December 31, 2023, there won’t be a disruption in status due to the moratorium. The IRS will promptly process Form W-7 applications submitted during the renewal period. Application status can now be monitored online through the E-Services account, with steps involving the signing of agreements online using the E-Services PIN.

New Applicants

For new applicants, an individual must complete and submit an IRS Acceptance Agent Application on behalf of their firm or organization. A comprehensive process must be followed:

- Complete mandatory ITIN Acceptance Agent Training and Forensic Training before submitting the application.

- Submit the electronic IRS Acceptance Agent Application through the IRS E-Services account.

- Utilize the CAA Documentation Upload Tool to promptly upload all required documentation, including Forensic Training Certificates, Professional Credentials, Citizenship documents, and Non-Profit Exemption Letter.

For further details on the application process and additional requirements for becoming an IRS Certified Acceptance Agent, interested parties can refer to the following resources on the IRS website:

- IRS Acceptance Agent Program Changes page

- Acceptance Agent Application FAQs

- How to Become an Acceptance Agent for IRS ITIN Numbers

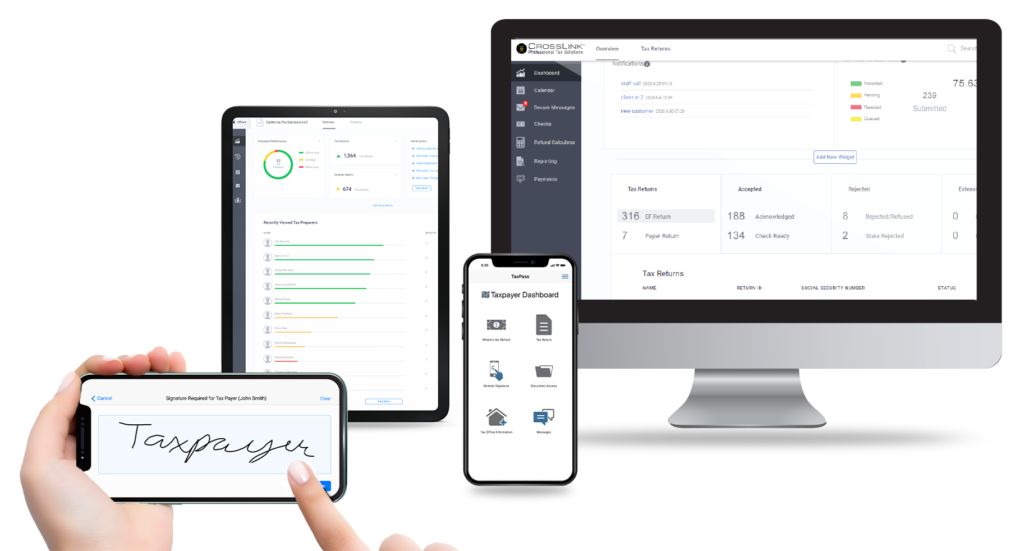

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.