The IRS has released its annual Dirty Dozen list of tax scams for 2024. This list serves as a warning to taxpayers and tax preparers about various schemes, abusive tax transactions, and tax avoidance strategies. It aims to raise awareness and prevent individuals from falling victim to fraudulent practices. Below are some of the most relevant scams highlighted by the IRS this year:

Bad Tax Advice on Social Media

Social media platforms often circulate inaccurate or misleading tax information. The IRS advises taxpayers to be cautious when relying on internet tax advice, as it may be fraudulent or based on false schemes. Examples include:

- Fraudulent advice on Form W-2: Scammers may suggest using tax software to falsify a Form W-2 with incorrect employer information, income, and withholding amounts to claim a large refund.

- Form 8994 Scheme: This scheme involves completing Form 8944 (Preparer E-File Hardship Waiver Request) to try to obtain a refund from the IRS.

The IRS warns that filing forms with false or fraudulent information can result in serious consequences, including civil and criminal penalties, such as criminal prosecution for filing a false tax return and a frivolous return penalty of $5,000.

For more information, refer to IRS News Release IR-2024-98.

Identity Theft Related Schemes

The IRS continues to warn taxpayers and tax preparers about various identity theft-related schemes. Here are the key schemes to watch out for:

Phishing and Smishing

Phishing and smishing schemes are designed to steal sensitive taxpayer information or take over a computer system. They often peak during the tax season but can occur at any time. Phishing involves fraudulent emails claiming to be from the IRS or other legitimate organizations, while smishing uses text messages with alarming language and fake links to trick individuals.

For more details, refer to IRS News Release IR-2024-84.

Offering Help with Setting Up IRS Online Account

Scammers are targeting taxpayers with offers to help set up their IRS Online Account. The goal is to steal personal information, including address, Social Security Number (SSN), and photo identification.

For more details, see IRS News Release IR-2024-87.

Spearfishing

Spearfishing targets specific individuals, organizations, or businesses with malicious emails. The goal is to get the recipient to click on a link or download an attachment that installs malware on their computer, allowing the fraudster to gain access to sensitive information.

“New Client” Scams

This type of spearfishing scheme targets tax preparers. Fraudsters send emails pretending to be new or potential clients, aiming to trick preparers into responding. Once the preparer responds, the fraudster may send a follow-up email with a malicious attachment or URL.

For more details on spearfishing and “New Client” scams, refer to IRS News Release IR-2024

Being aware of these schemes and exercising caution when dealing with unsolicited communications can help taxpayers and tax preparers protect themselves from identity theft and fraud.

Abusive Credit Schemes

The IRS is highlighting two abusive credit schemes for 2024:

Questionable Employee Retention Credit Claims

The IRS warns against unscrupulous and aggressive promoters who advertise questionable claims for the Employee Retention Credit (ERC). Businesses and entities are advised to steer clear of such promoters. Falsely claiming or inflating the ERC can lead to repayment of the credit, as well as penalties, interest, and potential criminal prosecution.

For more information and signs to look for regarding incorrect ERC claims, refer to IRS News Release IR-2024-85.

False Fuel Tax Credit Claims

There has been an increase in fictitious claims for the fuel tax credit. Taxpayers are warned to be cautious of promoters who encourage improper claims for this credit on federal tax returns. The fuel tax credit is only available for off-highway business and farming use, and most taxpayers are not eligible.

For more details, see IRS News Release IR-2024-89.

Being aware of these schemes and avoiding aggressive or false claims can help taxpayers and businesses avoid potential penalties and legal issues.

Offer in Compromise (OIC) Mills

OIC mills are companies that advertise on radio and television, promising to settle taxpayer debt at steep discounts for pennies on the dollar. These claims are often exaggerated, and the mills typically charge excessive fees. In reality, taxpayers could obtain the same service directly from the IRS without the need for these mills.

While OIC mills operate throughout the year, they are more visible after the filing season as individuals seek to resolve their tax issues.

Taxpayers are advised to be cautious and seek guidance from reputable sources when dealing with tax debt resolution services to avoid falling victim to such misleading claims.

For more details, refer to IRS News Release IR-2024-91.

Fake Charities

The IRS is cautioning taxpayers about fake charities that masquerade as legitimate charitable organizations to solicit donations. These fake charities are particularly prevalent after disasters, taking advantage of people’s generosity.

Scammers create fake charitable organizations to deceive individuals into donating money. In addition to taking taxpayers’ money, these scammers also solicit personal and financial information, which can be used for tax identity fraud.

Taxpayers are advised to research charities before donating and to be cautious of unsolicited requests for donations, especially after a disaster, to avoid falling victim to these scams.

For more information, refer to IRS News Release IR-2024-92.

Digital Asset Schemes

Some unscrupulous promoters are falsely claiming that digital assets are untraceable and undiscoverable by the IRS. They suggest that taxpayers do not need to report any transactions involving digital assets on their tax returns.

Taxpayers should be aware that all income, including that from digital assets, is subject to taxation, and failure to report such income can lead to penalties and legal issues.

For more details, refer to IRS News Release IR-2024-105

Other Tax Scams Covered in 2024 IRS Dirty Dozen

Other schemes and tax avoidance strategies that were included in the 2024 IRS Dirty Dozen were:

- Taxpayers to watch out for “Ghost” preparers

- Improper Art Donations

- Charitable Remainder Trusts

- Monetized Installment Sales

- Syndicated Conservation Easements

- Micro-captive Insurance Arrangements

- Maltese Individual Retirement Arrangements

See the Dirty Dozen page on the IRS website for more information on these additional schemes and tax avoidance strategies that the IRS wants to make taxpayers aware of for 2024.

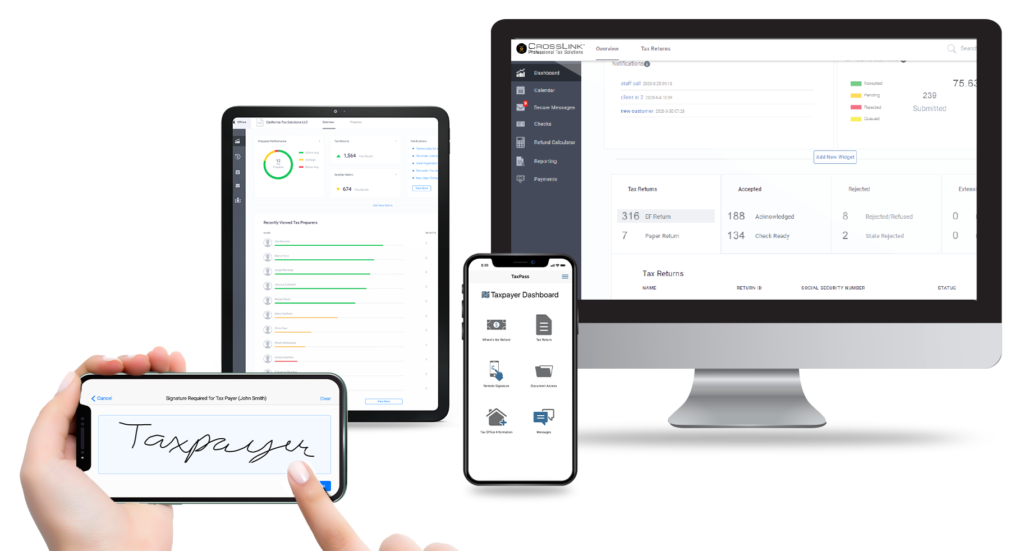

Taxpayers should be aware of the risks posed by unscrupulous promoters and take steps to protect themselves. By staying informed, exercising due diligence, and seeking advice from reliable sources, taxpayers can minimize their exposure to fraud and ensure compliance with tax laws. If you are a tax professional, consider using CrossLink Professional Tax Solutions to increase your efficiency and simplify tax compliance for your clients.

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.