Complete List of 32 States with a Taxpayer Access Point or Online Account

The following States offer some version of a taxpayer online account.

How To eFile Taxes Like a Professional

Learn how to efile taxes as well as what e-filing is, how it works, and the advantages of e-filing your taxes in this detailed article.

Detailed Breakdown to the Question “How Do Taxes Work?”

How Do Taxes Work? The U.S. tax system is extremely complex, leading many often ask the question, “How do taxes work?” This article is meant to help you understand what taxes are, how taxes work, the different tax forms that exist, and how to file your taxes. What are Taxes? Income taxes are a type […]

Advantages of Creating an IRS Online Account

Creating an IRS Online Account For your average taxpayer, filing their yearly tax return can be confusing and frustrating. There are many tools and resources out there that can help the individual taxpayer, and one of them is an IRS Online Account. From accessing the adjusted gross income (AGI) from their prior year’s tax return, […]

When to Apply for a New EFIN

When do I need to apply for a new EFIN? Background: Effective in Tax Year 2011, federal legislation mandates that anyone filing more than 10 tax returns must file electronically. Before you can electronically file tax returns, you must apply to become an Authorized e-File Provider (“Provider”) with the IRS. Become an Authorized e-file Provider […]

States With Special Laws Regarding Bank Products Fees

States With Special Laws Regarding Bank Products Fees Background: Arkansas (AR), Connecticut (CT), Illinois (IL), Maine (ME), Maryland (MD), and New York (NY) require tax preparers to charge the same fees to all clients irrespective of whether or not a client uses a bank product to facilitate payment of their refund. More details on the […]

IRS Document Upload Tool Now Available for Certain Notices

The IRS announced on February 16, 2023 that they will now give taxpayers who receive certain notices requesting them to send documentation the option of uploading the documents via their secure IRS document upload tool instead of mailing them in.

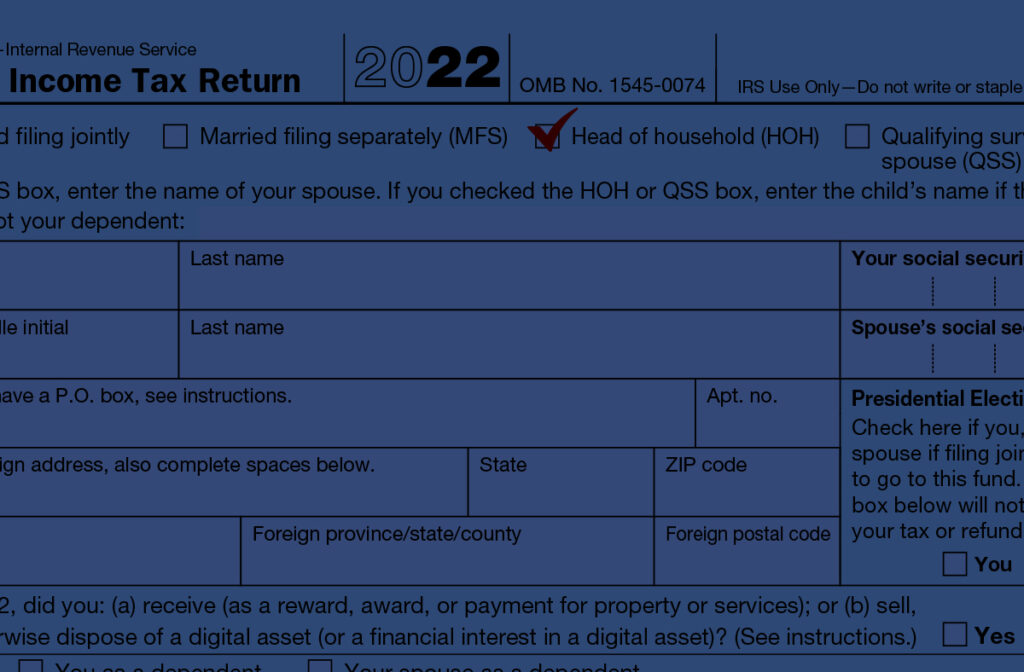

Head of Household

The Head of Household Filing Status is included as part of a tax preparer’s due diligence requirements.

Form 8962 Reminders for Tax Season 2023

Tax preparers must remember that if a taxpayer received an advance premium tax credit (subsidy) to help pay for their health insurance that they obtained through an Exchange, they must complete (including the reconciliation of the advance premium tax credit) and include the Form 8962 (Premium Tax Credit) with their federal return.

Premium Tax Credit

What is the Premium Tax Credit? The Premium Tax Credit is a refundable tax credit for certain people who enroll, or whose family member enrolls, in a qualified health plan that they obtain through a health insurance Marketplace. This credit provides financial assistance to pay the premiums for a qualified plan by reducing the amount […]