Beginning in 2024, all corporations, limited liability companies, and certain other businesses are required to file a beneficial ownership information report with the Financial Crimes Enforcement Network (FinCEN).

What is the Corporate Transparency Act?

The Corporate Transparency Act was enacted at the beginning of 2021 as part of the Anti-Money Laundering Act of 2020. This legislation authorized FinCEN to collect ownership information on specific companies (called reporting companies) and disclose it to authorized government authorities and financial institutions to assist in pursuing financial crimes. FinCEN is a bureau of the United States Department of the Treasury.

What Types of Companies Must File a Beneficial Ownership Information (BOI) Report?

All reporting companies must file a BOI report. Reporting companies include corporations, limited liability companies (LLCs), limited partnerships, limited liability partnerships, or any entity created by filing a document with the Secretary of State or similar office under state or tribal law, or any company formed under foreign laws and registered to do business in the United States.

Who Is Exempt From BOI Reporting?

The reporting rule exempts accounting firms, tax-exempt entities, large operating companies, and 20 other types of entities from the reporting requirements. Sole proprietorships and general partnerships are also exempt.

A large operating company is defined as an entity that has an operating presence in the United States, employs more than 20 employees and employs more than 20 employees in the United States, and has more than $5 million dollars in gross receipts or sales.

For a full list of exempt entities, see the Small Entity Compliance Guide beginning on page 4 on the FinCEN website.

What is the Reporting Requirement?

Beginning January 1, 2024, reporting companies will be required to file a beneficial ownership information report with FinCEN – BOI.

Reporting companies are required to file their initial report as follows:

- Companies already in existence as of January 1, 2024: January 1, 2025

- Companies created during calendar year 2024: 90 days after they were created or registered with a State

- Companies created after December 31, 2024: 30 days after they were created or registered with a State

After filing their initial report, a reporting company will only need to file another beneficial ownership report when they need to report changes to their initial report. The company must report any changes within 30 days of when they become aware of a change or has reason to know of an inaccuracy in their initial or earlier report.

What Type of Information Must Be Reported?

When filing a Beneficial Ownership Report with FinCEN, the reporting company must provide the following information:

- Company Identifying Information: This includes the legal name of the entity, address, jurisdiction in which it was first formed and registered, and tax identification number.

- Identifying information on beneficial owners: This includes the name, birth date, address, ID number from their passport or driver’s license, and an image of the document with ID. These are the individuals who ultimately own or control the company.

- The information in these reports to FinCEN can only be disclosed by FinCEN to a government agency, law enforcement, or financial institution for compliance with anti-money laundering or other diligence obligations.

Reporting companies created on or after January 1, 2024, must also report their company’s applicant(s), who fall into two categories:

- Direct Filer: This is an individual who filed the document with the Secretary of State or similar office that created the reporting company.

- Directs or Controls the Filing Action: This is an individual who was primarily responsible for directing or controlling the filing of the creation or first registration document.

A reporting company can have no more than two company applicants. For further details, refer to the Small Entity Compliance Guide starting on page 37.

Who is a Beneficial Owner?

An individual is considered a beneficial owner if they meet either of the following criteria:

- Exercise substantial control over a reporting company

- Own at least 25% of the ownership interests of a reporting company

A reporting company can have multiple beneficial owners, and there is no maximum limit on the number of beneficial owners that must be reported.

An individual is deemed to exercise substantial control if they fulfill any of the following criteria:

- They hold a senior officer position

- They have the authority to appoint or remove certain officers or a majority of directors

- They are an important decision-maker

- They have any other form of substantial control over the reporting company

Ownership interests that qualify for beneficial ownership include:

- Equity, stock, or voting rights

- A capital or profit interest

- Convertible interests

- Options or other non-binding privileges to buy or sell any of the above

- Any other instrument, contract, or mechanism used to establish ownership

For more information and guidance on identifying a company’s beneficial owners, refer to the Small Entity Compliance Guide, specifically pages 16 to 28.

How To File a Beneficial Ownership Information Report

Companies must file a beneficial ownership information report electronically via the FinCEN’s filing system on the FinCEN website.

See the BOI E-Filing Help and Resources page on the FinCEN website for detailed instructions on how to file the report.

Penalty for Not Reporting or Reporting False Information

The penalty for not filing or reporting false information is $500 per day for each violation, up to a maximum of $10,000 and/or imprisonment for up to 2 years.

For More Information

See FinCEN’s website for:

- Beneficial Ownership Information Reporting – Frequently Asked Questions

- Small Entity Compliance Guide

- An Introduction to Beneficial Ownership Information Reporting

- Beneficial Ownership Information Reporting Quick Reference Page on FinCEN

- Small Business Resources page

- FinCEN – Beneficial Ownership Information main page

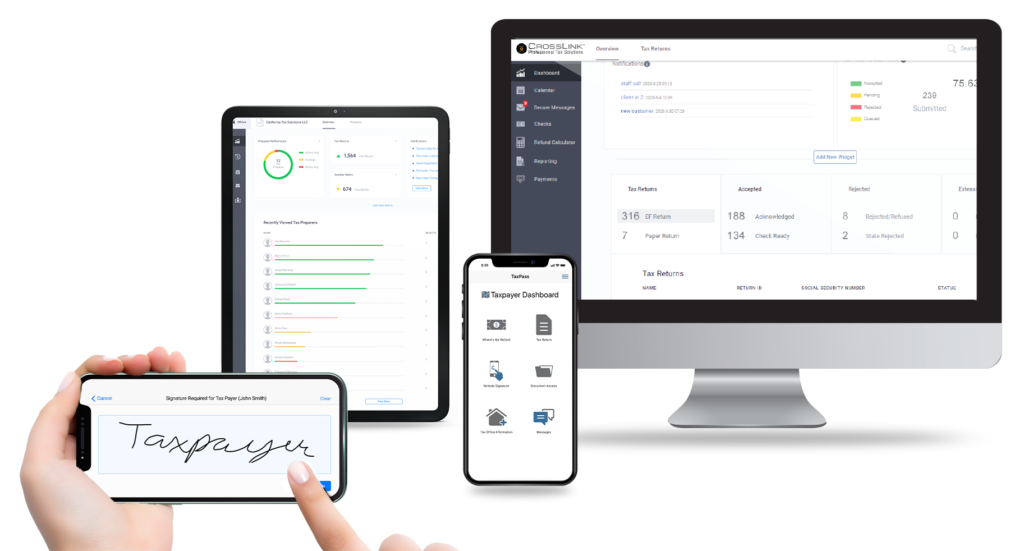

CrossLink Professional Tax Solutions

CrossLink is the industry’s leading professional tax software solution for high-volume tax businesses. Built based on the needs of busy tax offices and mobile tax preparers that specialize in providing their taxpayer clients with fast and accurate tax returns, CrossLink has been a trusted software solution since 1989. CrossLink’s in-depth tax calculations, advanced technological features, and paperless solutions allow you to prepare the most complicated tax returns with confidence and ease while providing your customers with an unparalleled experience.